Time:2022-07-25 Views:1

Overview

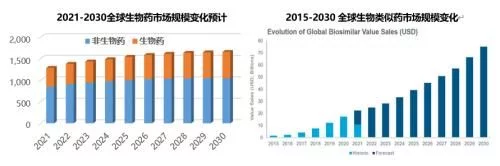

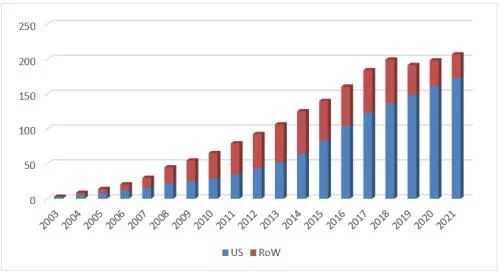

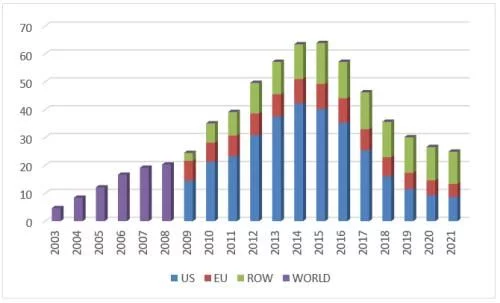

In 2021, the global biopharmaceutical market will reach US$430 billion, accounting for 1/3 of the overall global pharmaceutical market. will reach $600 billion in 2029. In the past five years, the global biosimilar market has developed rapidly with a CAGR of nearly 50%, reaching a scale of US$20 billion in 2021. The two major markets in Europe and the United States account for more than 80%, and it is expected to continue to grow at a CAGR of more than 15% in the next decade. continued rapid growth.

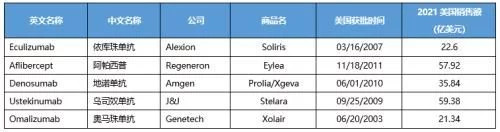

Among the top 100 drugs by global sales in 2021, there are 55 biomacromolecules such as monoclonal antibodies, accounting for 64% of sales revenue . Biological drugs occupy 6 of the TOP10 drugs. Except for vaccine products, the global sales of TOP20 biological products in 2021 are monoclonal antibodies and antibody fusion proteins; the sales of each product are more than 3 billion US dollars, of which nearly half of the product revenue More than US$5 billion; the US market is at the core, 85% of the TOP20 products in the US account for more than 50% of global sales; 19 other products except ocrelizumab have been approved Enter Chinese market.

2021 global sales TOP20 biological drugs (non-vaccine)

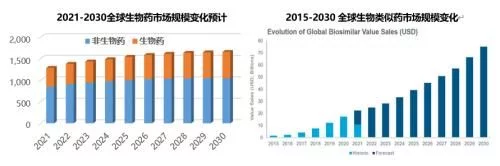

Look at the United States and know the world. Under the background of the raging epidemic, the overall size of the U.S. pharmaceutical market in 2021 (in terms of invoice amount) ) reached a new high and steadily increased to US$580 billion. The booming biopharmaceuticals accounted for 45% of the overall sales, and it is expected to reach US$340 billion in 2030, with a share of 50 %.

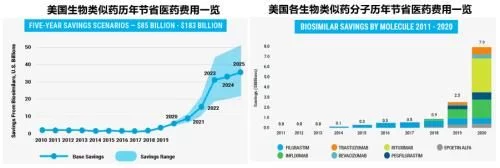

The U.S. biosimilar market capped an unusual 2021 with a $6.8 billion performance, nearly 5 years CAGR reached 147%. With the launch of insulin glargine, ranibizumab and other new products and the first biosimilars of adalimumab, the US biosimilar market is expected to exceed US$10 billion in 2023. In addition to sales, affected by the epidemic, whether it is drug administration registration, new product launch or legal proceedings, it seems that the slowdown button has been pressed, but "the first ophthalmic product was approved" and "the first biosimilar drug was approved." A series of milestone achievements such as "replacement qualification" and "the average penetration rate of biosimilars in the city exceeded 50%" still made the seemingly peaceful past year shine with due brilliance, just like the afterglow of the warm sun No longer dazzling but still brilliant.

Approved & Listing

In the first 350 days of 2021, only two biosimilars, Mylan's Semglee and Samsung's Byooviz, were approved, the former being the first A true insulin glargine biosimilar, although it is essentially just adding a new identity to the marketed product that was approved as 505(b)(2) and then converted to BLA, it is still of great significance. On the one hand, insulin has become a new member of the U.S. biosimilar family, and on the other hand, the first FDA to grant the title of interchangeable biosimilars makes automatic replacement no longer just theoretical at the operational level; the latter is the United States. The first ranibizumab and the first ophthalmic biosimilar, a brand-new one-stop service of "new molecule + new field + new therapy + new choice" for the future Brings infinite hope full of youthful vitality.

Just when everyone thought the number of biosimilars approved in the U.S. in 2021 would end at a dismal two, Lilly's Rezvoglar and Coherus' Yusimry were approved one after another on December 17, and the number of approvals was finally fixed at 4, which was a slight stop from last year's decline. Rezvoglar became the second biosimilar of insulin glargine approved in the United States after Semglee. The basically similar routine is only the halo of interchangeable qualifications missing from the top of the head. Yusimry is the second biosimilar approved by Coherus after Udenyca. The eighth adalimumab biosimilar that has completed a settlement with Abbvie will be launched in the U.S. market by the end of next year according to the settlement agreement.

In the first 4 months from 2022 to the present, the US biosimilar family has added two dollars, Kashiv's Releuko and Amneal's Alymsys was approved in February and April, respectively, making the two products the third biosimilars approved for filgrastim and bevacizumab, respectively.

2021-2022 US Biosimilar Approvals Overview

(as of end of April)

Judging from the review time, all 5 products except Releuko were finally approved after one year of application, and the process was quite The smooth progress also reflects that with the accumulation of application experience in the past few years, all major companies have a more thorough understanding of the US biosimilar drug registration system and FDA review ideas under the premise that the quality of the registration documents themselves is guaranteed. The only exception, Releuko, was declared as early as July 2017. Due to a series of quality problems in R&D and on-site inspections, it took 4 CRs before and after it finally passed the test, and it was accepted once a year until the CRL was soft. The 1693-day review period made Releuko surpass Sandoz's Ziextenzo to become the first in history with a huge advantage of 163 days. As one of the few domestic biosimilar manufacturers, Kashiv and its acquisition predecessor Adello faced endless challenges. The spirit of perseverance in times of hardship is still worthy of recognition. This case once again confirms that high speed based on high quality is meaningful.

Semglee has been listed at the end of last year, and Byooviz and Yusimry are subject to the settlement agreement of Roche and AbbVie respectively and still need to wait , Eli Lilly has not yet announced the listing plan of Rezvoglar, together with two other products that will be sold by Amneal, are expected to enter the US market as soon as the second half of this year.

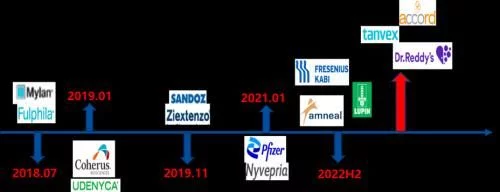

Ruxience and other 3 biosimilars were successfully launched in 2021, and the number decreased again compared with the previous year. The longest interval is 7 months, and the shortest is only 1 month. At present, there are no litigation problems for the three products. Riabni and Nyvepria became the third and fourth rituximab and PEGGCSF biosimilars to be marketed in the United States, respectively, and Semglee became the first insulin biosimilar to be marketed.

20201-2022 List of Biosimilars in the U.S.

(as of end of April)

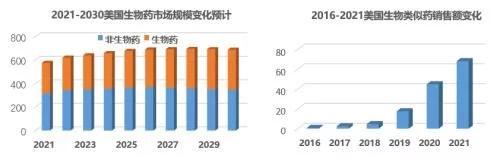

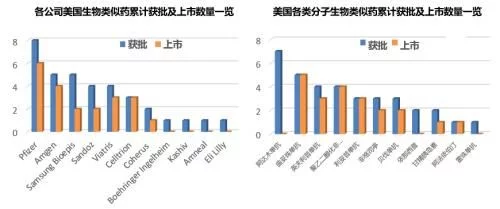

Up to now, the total number of biosimilars approved and listed in the United States under the 351(K) route has reached 35 and 21. In terms of product types, there are 11 molecules involved in the three major fields of maintenance therapy, anti-tumor and autoimmunity. Among them, adalimumab has the largest number of biosimilars, and a total of 7 biosimilars have been approved. Only 1 biosimilar has been approved for trastuzumab, and trastuzumab has become the most competitive product with 5 biosimilars approved and all of them are on the market; from the company's point of view, a total of There are 11 companies including R&D-focused, large-scale generic drug companies, among which Pfizer ranks first with 8 product approvals and 6 product listings. Of the 14 biosimilars that have been approved and unmarketed, 10 are limited by patents, and the rest are mainly due to commercialization strategies that are not yet on the market.

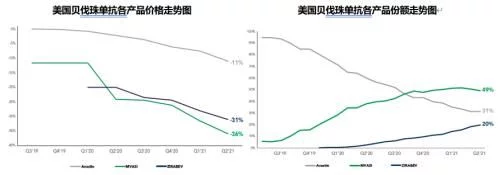

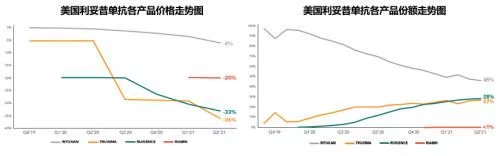

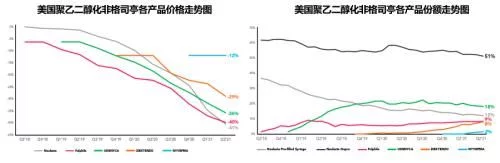

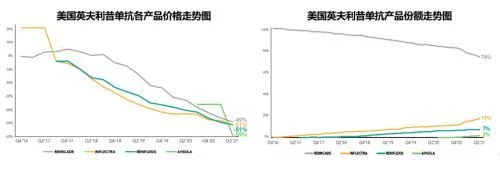

Penetration & Price

For the penetration of biosimilars in the United States, if 2019 is the beginning of Xiaohe's sharp corners , 2020 is the next city where sesame blossoms are growing steadily. In 2021, there will be thousands of trees and thousands of pears blooming in competition. If you want to compare with Tiangong, the yellow flowers on the battlefield are particularly fragrant. Under the background that the marketed biosimilars continue to lower the overall market price through competition with each other and with the original research drugs, the pharmaceutical expenditure in the United States has been greatly saved. $7.9 billion and forecasts at least another $85 billion in spending savings over the next five years.

Since Sandoz's filgrastim biosimilar Zarxio entered the U.S. market in 2015, biosimilars have been saving for several years The huge role of expenditure has caused all parties in the distribution channel to gradually show a positive attitude towards it. The understanding and acceptance of similar drugs has greatly improved. Time has passed, and although some biosimilars still face stubborn resistance in various forms from the original research products in multiple links, the trend is irreversible, and the dark age in the early stage of development is gone forever. The significant improvement in the general environment has greatly promoted the accelerated penetration of biosimilars in the past year, and the market share of multiple molecules has been greatly increased. For the products and the company itself, the advantages of the group have gradually formed, one after another. The granting of interchangeable designation for the two products also brightens the prospects for future development of biosimilars. At present, the number of biosimilars in the city has reached 21. With the addition of several biosimilars after the settlement date of the blockbuster product Humira next year and the acceleration of the FDA review after the epidemic has eased, the penetration rate of biosimilars has increased. will be further improved.

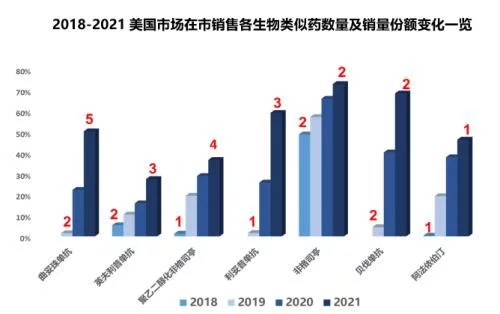

From the perspective of specific figures, by the end of 2021, the biosimilar market with 7 biosimilar products sold in the market ( Excluding Semglee, which was launched at the end of the year, the sales share is more than 35%, and the penetration is particularly obvious in the anti-tumor field. The three products of bevacizumab, rituximab and trastuzumab are biosimilars. All exceeded 50% last year, and 4 of the 7 molecules have 3 or more biosimilars in the market. Filgrastim biosimilar has increased its share to 73% after more than five years of development since it was launched on Zarxio, becoming the product with the largest sales volume of biosimilars; two of the products involved in infliximab have been listed in 2017 Under the unremitting sniping of the original research, the biosimilars have achieved a commendable 12% growth in the past year, increasing the overall share to 27%, which is still the product with the slowest penetration and the lowest sales volume; by Celltrion's Truxima and The rituximab biosimilar product group composed of Pfizer's Ruxience has grown by 33% last year, becoming the product with the fastest penetration rate in 2021; from the perspective of specific single product share, Sandoz's filgrastim biosimilar The drug Zarxio ranked first with a share of 59%, and 5 of the 7 biosimilars ranked first in the 7 molecules were the first generic products. Among them, the first generic product of PEGGCSF, Fulfila, ranked at the bottom of all the first generic products with a share of 8.2%.

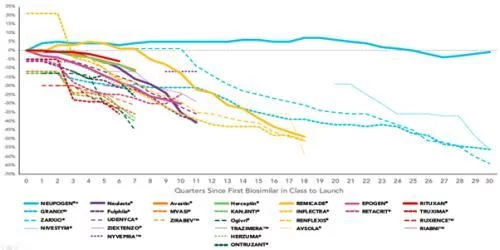

Celltrion's rituximab biosimilar, Truxima, was launched in November 2019, becoming the first biosimilar currently available in the market. It has been two and a half years since the first imitation product of the seven molecules sold in the market last, and the earliest Zarxio was launched six and a half years ago. Competing products have been launched one after another. Although the number and duration of competing products of different molecular biosimilars are different, they have all lowered the overall market price through competition to varying degrees. Compared with the price of the original research product before the listing of biosimilars, the ASP price of the current lowest product has dropped by 32%-73%, and the drop of 6 products has exceeded 50%. The price of filgrastim, which has penetrated for the longest time, has dropped the most, exceeding 70%; in recent years, only one biosimilar, epoetin alfa, which has been sold in the market, has experienced the smallest price drop, which is close to 33%. The biosimilars corresponding to Roche's three-piece anti-tumor kits have only entered the market in 2019, but the price cuts have all exceeded 50%, and the most competitive trastuzumab has dropped by 60%.

Strategies & Pipelines

The rivers and lakes of biosimilars are also like a besieged city. Some people in the city come up with it, and accept it as soon as possible. And to do it, go away after doing things, and hide the merit and fame; some people outside the city want to go in, have infinite longing, and what their hearts want. There is no right or wrong in the world of rivers and lakes, there are different angles and strategies, and the one that suits you is the best, but no matter how time passes or the years change, the sword, light and sword shadows in front of you never stop, and the sound of drums bursts in your ears. Never say goodbye, even if the old friend has gone, your legend is still circulating in the rivers and lakes.

The times create heroes, and one seedling wins the world. Pfizer, a big pharmaceutical company in the universe, has relied on the phenomenon of the new crown mRNA vaccine Comirnaty in the past year. The top performance has returned to the No. 1 hegemony. The 81.3 billion U.S. dollars in the sky has made all the bigwigs discouraged. The little money made by selling biosimilars is really a drop in the ocean. Biosimilars to Pfizer are just passing by for a long time, and the former deceased is no longer on the research pipeline list;

Even if I don't know each other, my face is full of dust and my temples are like frost, Mylan in the past is shining, and I look a little like before. ? With the merger, Viatris, which was upgraded to the world's number one generic drug giant, finally decided to sell its global biosimilar business to Biocon, an all-weather strategic partner, for $3.3 billion in the context of global strategic adjustments. The road of relying on external resources to develop biosimilars has finally come to an end. When I waved goodbye, I left 12.9% of the shares to prove that I have come and never really left;

There is a kind of love called being brothers after breaking up. Samsung and Biogen, who have walked hand in hand for 10 years, finally officially announced this year. Announcing the breakup, leaving behind the crystallization of love Samsung Bioepis handed over to be raised by Samsung alone, although Samsung is This paid a astronomical breakup fee of 2.3 billion US dollars, but the family relationship with Biogen is still there, and the sales cooperation between the two parties in many markets mainly in Europe will continue;

Teva, who bid farewell to the first brother of generic drugs, is somewhat lonely. This retirement may be a lifetime, and the future of Celltrion, the Korean younger brother who has been supporting I still want to go it alone and make my second brother feel more desolate, but there is a victory called retreat. If the heart is there, the dream is there, the carved fence and jade should still be there, it's just Zhu Yan's change;

Sandoz, who is always striving for the first place, is still persistent in his pursuit of day and night on the way forward, determined to use practical actions Prove that you are still working hard for the rich dad to see yourself, don't always mention separation, a wave of new varieties developed by yourself and imported from outside is about to blossom and bear fruit, and the dream of 6 billion in 2030 is still beautiful;

Hikma, who is full of blood in the Spring and Autumn Period, has lofty ambitions and lofty ambitions, officially debuted in the circle after several thoughts. , In the past year, I have joined hands with two small partners to make an agreement to travel together, let's go, don't ask where the road is, the wind is the only way.

Estimated launch schedule for major biosimilars under development in the U.S. market

Biosimilar pipeline overlap product overview

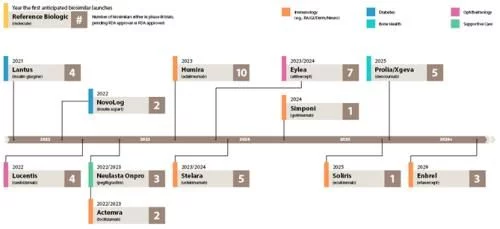

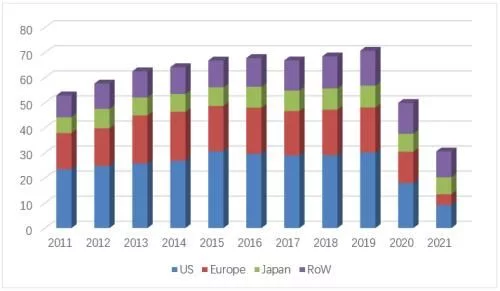

From the perspective of specific products, all the bigwigs who are committed to playing in the US market hold multiple clinical trials or FDA The products in the review stage are basically the products that can be launched in the near future after the main patent of the original research product expires in the next few years. The similarity of the products is relatively high. Among them, several products such as denosumab overlap, and these overlapping products The current US market sales of original research products are more than 2 billion US dollars. If the first wave of biosimilars such as filgrastim and EPO, represented by Zarxio, have opened up the world and are on the road to success, it has opened the prelude to the vigorous development of biosimilars in the US market. The second wave of monoclonal antibodies and antibody fusion protein biosimilars, which are the reference targets of adalimumab and other rheumatoid three musketeers, will continue to build on the past and make persistent efforts, creating a good situation for the development of current biosimilars. Then ustekinumab The third wave of biosimilars, represented by them, will soon be on the stage in the spotlight, shouldering the historical mission of making biosimilars bigger and stronger.

Teva still insists on self-developed and externally introduced two-legged walks. Currently, two channels of biosimilars are in the research pipeline. The proportion of products is basically the same. The externally introduced products are mainly from Alvotech. The two parties reached a strategic partnership for the US market in August 2020. The biosimilar adalimumab, which is the fastest-growing product in the cooperation, will be launched next year. The US market; Sandoz has begun to take the route of external introduction in order to speed up and reduce risks in recent years. The existing pipeline products come from multiple partners such as Polpharma, EirGenix, Gan& Lee, etc., and the strategy reached with Biocon in 2018 The alliance will also further enrich its product line in the future; Celltrion also intends to further expand into the field of biosimilars in the future after testing the waters in the field of small-molecule chemical drugs and independent sales. Currently, the fastest progressing adalimumab has been declared this year; Samsung will still focus on R&D and production in the future. Merck, Biogen and other partners will continue to be responsible for sales in the U.S. market. Bevacizumab, the fastest-growing new product, is still under FDA review; Amgen's three products are all under review. Already in Phase 3 clinical stage, eculizumab, which is progressing the fastest, has achieved reconciliation with the original research company and can be launched in the United States in 2025; traditional small molecule generic drug companies such as Hikma and Amneal, which have been transformed in recent years, will still be in the initial stage. The main strategy is to hoard products through external cooperation and gradually enrich the product line. In the future, it will not be ruled out that it will expand from registered sales to independent production with its own development in this field.

Litigation Progress

In November 2013, Amgen and Sandoz filed a lawsuit in the U.S. District Court for the Northern District of California concerning patented dance interaction data under the BPCIA framework. The dispute announced the official start of the patent battle between biosimilars and the original research company in the form of BPCIA litigation. In the following eight and a half years, the second position outside the market was full of gunfire and smoke. He Weigui is short-lived and quick, regardless of whether they win or lose, whether they succeed or fail, each vivid case has written a strong stroke in the history of the development of biosimilars.

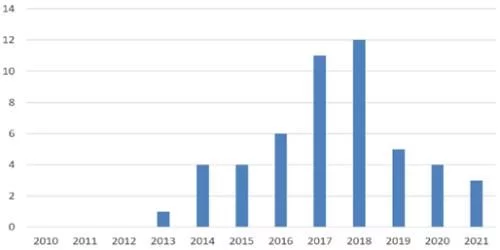

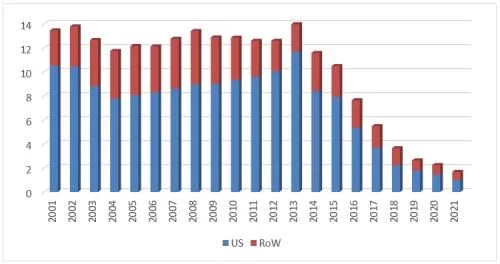

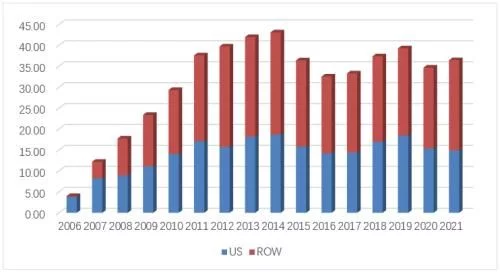

The number of BPCIA lawsuits in the United States over the years

By the end of 2021, the cumulative number of BPCIA lawsuits in the United States has reached 50, many of which have been filed against the same product in different regions or Homologous litigation against different patents. In terms of scope, from 2013 to 2021, at the district court level in charge of the preliminary trial, four original research drug companies, Amgen, Genetech, Janssen and Abbvie, have filed all 9 molecules, including adalimumab, which currently have biosimilars approved. 14 group companies including Celltrion filed lawsuits, involving a total of 30 biosimilars (some of which were not approved); in terms of time, 2017 (11) and 2018 (12) became the most concentrated time periods for lawsuits, occupying In the past three years, 5, 4 and 3 lawsuits were filed respectively.

From the perspective of the company's performance, Amgen plays the role of the plaintiff and the defendant, and has become the most active one among the companies involved in the lawsuit. Plaintiffs initiated 16 lawsuits and took on 8 lawsuits as defendants, both of which were the highest of any company. Genetech was the second plaintiff with 15 lawsuits, Celltrion and Sandoz with 7 and 6 lawsuits respectively. Ranked the second and third of the defendants; in terms of time-consuming, Sandoz's filgrastim biosimilar Zarxio and Celltrion's infliximab biosimilar Inflectra took nearly five years from the initial lawsuit to the final victory. The longest-running biosimilar product, Sandoz's adalimumab biosimilar Hyrimoz took only 2 months from being sued to finally reconciling with the original researcher, making it the product with the shortest litigation time; Among the lawsuits initiated by the products, 20 products ended in settlements.

There is currently only an ongoing lawsuit for Samsung Bioepis' bevacizumab biosimilar (SB8) product, which The product BLA was declared in September 2019 and has not yet been approved. In June 2020, the original researcher, Genetech, sued the court for infringing 14 patents. The case is currently at a standstill. The three BPCIA lawsuits in 2021 all stem from the high-concentration (100mg/ml) adalimumab biosimilar infringement dispute between Abbvie and Alvotech, which was settled in March this year.

BPCIA lawsuits in many cases involve killing one thousand enemies and self-destructing eight hundred. The ratio of input and output of litigation under the market situation determines their respective strategies and determination to solve the problem. The case of Amgen's etanercept vividly demonstrates the "intentional killing of the enemy and the powerlessness" of biosimilar drugs when the original researcher takes the initiative. However, in more cases, the original research companies that do not have an absolute advantage in the face of the firm belief and risk-taking strategy of "Kou can go, I can go" based on their own judgments of biosimilars finally ended with a reconciliation that took a step back. But a tenacious fighter like Amgen, who sees no draw but only wins and losses, is really fierce, and his fearless spirit in the process of defending his own multiple product sovereignty is enough to shake many opponents.

BPCIA litigation is not the only weapon to resolve the dispute between biosimilars and original research. So far, many cases are mainly focused on targeting the first The first wave and the second wave of blockbuster product biosimilar penetration started in the early stage. With the successful listing and accelerated penetration of many biosimilars, some original research companies rationally chose non-litigation settlements and other more lenient options under the circumstances that the situation has passed. way to face it. For biosimilar drug companies, in addition to passively accepting challenged lawsuits, it is often more effective to invalidate the original research patent through the multi-party review (IPR) method more proactively. Of the 21 biosimilar products currently on the market in the United States, a total of 16 involve BPCIA litigation, and 11 of them opt for a risky listing before patent resolution.

In recent years, the decrease in litigation cases has something to do with the impact of the epidemic, but it is more because the Between the challenges of the two waves of old drugs and the subsequent third wave of blockbuster new product challenges, the application and litigation of new drugs after the old drugs will become a new focus in the next few years.

Product Performance

1. Adalimumab

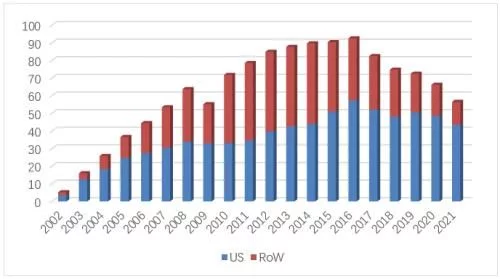

27 price increases in 19 years finally made Humira achieve the long-cherished wish of "breaking the second" in 2021, although it was lost due to force majeure It has won the crown of the annual drug king, but the feat of global sales of 20.694 billion US dollars in a single year and a historical accumulation of 192.7 billion US dollars is enough to shine in the annals of history. The patent farewell battle in 2022 has begun, and the era of dominance is about to come to an end.

Humira's global sales over the years

In 2021, the overall price of Humira in the U.S. market will increase by about 8% compared with the previous year, and sales will account for 10% of the total global revenue. The proportion continued to rise to 83.7%, the highest in the past 18 years, second only to 87.8% in the first year of listing. The sales volume has further increased by 8% on the basis of exceeding 10 million last year. From the perspective of packaging form, there are currently two packaging forms of injection pen and prefilled syringe. The sales share of the former has further increased to 89%; from the perspective of specifications, the overall share Further shifting to 100mg/ml large-scale products has increased from 48% in 2019 to 80%, becoming another barrier for original research to resist biosimilars. Compared with the earliest approved 50mg/ml product, the 100mg/ml product launched by Abbvie in 2016 has changed the prescription. The removal of citric acid reduces the pain of the patient during injection, and the use effect is better.

U.S. adalimumab biosimilar settlement and

List of registrations

In the past 5 years, Abbvie has reached settlement agreements with 10 companies, of which Amgen has the advantage in time, the earliest It can enter the market in January 2023, leading other companies for at least half a year. BI is currently the only biosimilar drug approved by the FDA to grant interchangeable qualifications. Alvotech has large-scale products that other companies do not have. It will become a major attraction after biosimilars enter the market in the future. In addition to the above-mentioned settled companies, Celltrion's adalimumab biosimilar Yuflyma (100mg/ml), which has been approved in the EU, is also in the FDA review process and will be approved as soon as this year

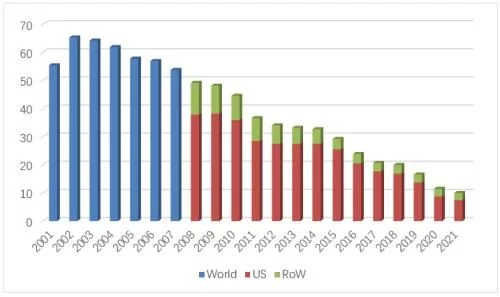

2. Bevacizumab

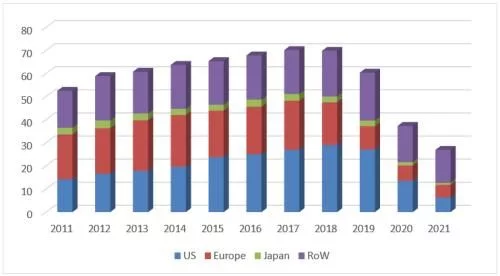

A number of competing biosimilars, led by Amgen/Mvasi, Pfizer/Zirabev and Qilu AnkeUnder the combined efforts of the three major markets of the United States, Europe and China, Avastin in 2021 will be defeated across the board, and sales will plummet by 49%, ending with a bleak end of 3.056 billion Swiss francs (equivalent to 3.36 billion US dollars), a refresh of nearly ten years. The worst record in years, after the two major markets in Europe and the United States completely collapsed, the decline is irreversible.

Avastin's global sales list over the years

In 2021, the sales revenue of the original product Avastin in the US market will be 922 million Swiss francs (about 1.013 billion US dollars), down 49% At the same time, the regional share of the U.S. market in global revenue fell to 30% for the first time in nearly a decade. Sales of Amgen's first bevacizumab biosimilar, Mvasi, surged to $826 million from $121 million in 2019 on the back of a good two-year launch. In terms of sales volume, the overall sales of bevacizumab in the U.S. market in 2020 increased by 7.2% compared with the previous year, reaching 2.15 million units, of which Mvasi’s share soared from 4% in 2019 to 48%, becoming nearly two The biosimilar drug product with the fastest penetration growth in recent years, the original research product Avastin's share further fell from 60% to 32%, Pfizer's Zirabev also achieved a breakthrough last year, and its share increased from 4% to 20%. In terms of specifications, there is not much difference between 100mg/4ml and 400mg/16ml products, the former has a slight advantage with a share of 50.9%. The overall market price has fallen further, and the current lowest average selling price (from Mvasi) in the first quarter of 2022 has dropped to $34/10mg, which is equivalent to 52% of the price of the original research product.

In addition to Mvasi and Zirabev, which are currently on sale in the market, Alymsys, a collaboration between Amneal and MAbxience, was approved in April this year, In addition, BAT1706 (reviewed in January 2021) by Sandoz and Bio-Tech, MYL-1402O by Mylan and Biocon (reviewed in March 2020), SB8 by Samsung Bioepis (reviewed in November 2019) And Celltrion's CT-P16 (declared in April 2022), the four bevacizumab biosimilars are all in the FDA review stage, and the competition in the US market for this product will intensify in the future. The IBI-305 declared to the U.S. BLA by the “Data + American Bridging Research” method has temporarily stopped moving forward. Cinda officially announced this month that it had terminated the cooperation with Coherus on this product that began in early 2020.

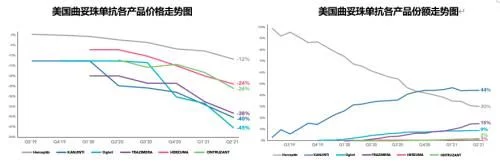

3. Trastuzumab

Herceptin, who was already behind bars and beleaguered on all sides, wanted to cry but had no more tears. The answer sheet of 2.694 billion Swiss francs (about 2.96 billion U.S. dollars), 28% of the four consecutive declines have no suspense, more painful than the failure itself is the helplessness in the face of failure, whether the law dictates, the mission is over, Rouge Tears, stay drunk, when heavy, naturally people grow and hate water and grow east.

Herceptin's global sales list over the years

In 2021, the sales revenue of the original research product Herceptin in the U.S. market will be CHF 636 million (about $699 million), compared to 2020 The 53% annual decline and the 23.6% share of the U.S. market are both record lows. In 2021, the battle for trastuzumab biosimilars in the United States is still the pattern of the top five competing for hegemony. With the joint efforts of all parties, the overall sales share of the biosimilar drug market has rapidly increased from 1.5% in 2019 to 50.2%. In 2021, the overall U.S. market sales of the product continued to decline to 1.34 million sticks, of which 67% came from the 150mg small size product. In 2021, Amgen's Kanjinti, the first imitation product, will further increase its annual share to 30% on the basis of last year's 17% annual share, leading all biosimilars. The US market sales of US$479 million have slightly increased compared to the previous year. Pfizer's Trazimera and ViatrIs' Ogivri followed with 9.1% and 8.9%, respectively, and the time-to-market for the two products was second only to Kanjinti, with a delay of 7 months and 4.5 months, respectively. The shares of Herzuma and Ontruzant, sold by Teva and Organon respectively, are relatively small, with neither exceeding 2%. The current lowest average selling price (from Amgen) has been reduced to $40.5/10mg, which is equivalent to 48% of the price of the original research product.

In addition to those currently sold in the city, Sandoz and Eirgenix's EGI014 (Declared in December 2021) and Tanvex's TX-05 (reviewed in October 2021) Both products are in the FDA review process, and Prestige's trastuzumab biosimilar has completed Phase III clinical trials and is expected to file for BLA in the second half of this year. my country's Henlius will grant the U.S. and Canadian commercialization rights of its trastuzumab biosimilar HLX02 to Accord in 2020, further expanding the scope of cooperation, and is expected to land in the U.S. market in the future after exporting to Europe.

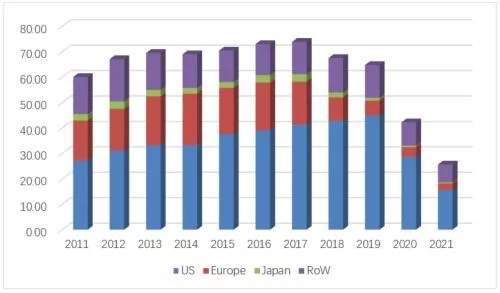

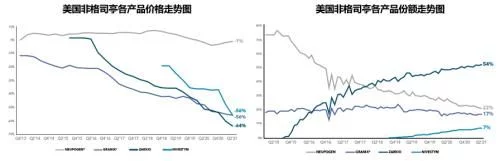

4. Rituximab

Same rhythm, same pace, as the world's first marketed anti-tumor monoclonal antibody, it is also in the Roche three-piece set The earliest product on the market and the product with the highest historical sales peak, Roche's rituximab research product Mabthera/Rituxan (respectively used in the European and US markets) also followed Avastin and Herceptin in the past year and suffered heavy losses in the European market in 2018. For the fourth consecutive drop after the fall, global sales fell by 39%, and finally closed at 2.565 billion Swiss francs (about 2.82 billion US dollars).

Mabthera/Rituxan global sales over the years

In 2021, the sales revenue of the original product Rituxan in the US market will be 1.552 billion Swiss francs (about 1.705 billion US dollars), compared with 2020 It fell by 46% year-on-year, accounting for 61% of global sales of original research products. The penetration of biosimilars also maintained the same high-speed advancement as the other two products in the three-piece set. The three biosimilars led by Truxima, the first generic product sold by Teva (from Celltrion), worked together to increase the share of biosimilars from 1.6% in 2019 improved to 59%. The overall U.S. market sales of this product in 2021 will be 2.19 million, basically the same as the previous year, 56% of which will come from small 100mg/10ml products. The original researcher’s annual share dropped from 74% to 41%, and it still leads the market temporarily. Pfizer’s Ruxience surpassed Truxima, which accounted for 26% of the annual share, with a 33% annual share, and rose to the first place in the biosimilar drug market, with a market share of 450 million. Sales were up 174% compared to the previous year, and Amgen's Riabni, which goes on sale in 2021, has less than 1% share. The current lowest average selling price (from Teva) has been reduced to $50.7/10mg, equivalent to 63% of the price of the original product.

Except for the 3 currently sold in the market, the subsequent competing products for the US market are relatively scarce, except that the US has been abandoned before. In addition to Sandoz in the market and Archigen, which abandoned the product due to unsatisfactory Phase III clinical results, the data shows that Dr Reddy's, which is developing the product for the European and American markets, has completed the Phase III clinical phase and is expected to complete the application this year.

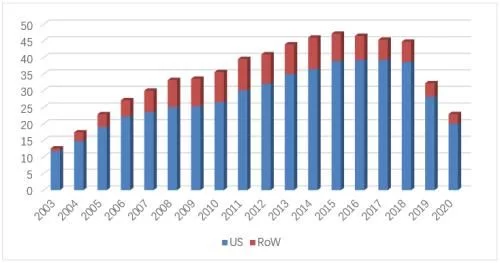

5. Filgrastim

In 2021, global sales of Amgen's original filgrastim research product, Neupogen, declined for the eighth consecutive year, to 1.68 The sales of the US market, which accounted for 60% of the record low of US$100 million, will also fall below US$100 million without any suspense. The overall global decline rate rebounded to 25% after a slight easing last year, and the battle will continue. Continue to wander with the soul torture of where the trough is.

Neupogen's global sales list over the years

In 2021, the US market sales of the original research product Neupogen will drop to US$101 million, a 30% decrease compared to the previous year. The overall market volume was 2.254 million, almost unchanged from the previous year, of which the proportion of prefilled syringes has risen to 82%. From the perspective of market competition, it is still the traditional situation of the top four competition since 2018. Teva's Granix is sandwiched between the original research product and the two biosimilars Sandoz/zarxio and Pfizer/Nivestym, and neither side is accounted for, although it is special A special product of the period, but has always been a major force in the competition. If the 351(a) product Granix is excluded, the market share of the two filgrastim biosimilars has reached 72.8%, making it the molecule with the highest penetration rate today. Zarxio has increased its share to 58% in the past year. In addition to being the earliest listed biosimilar, it is also the product with the largest share of biosimilars currently on the market, followed by Pfizer's Nivestym with a 14% share. If Granix is included, the shares of Zarxio, Granix and Nivestym are 47.8%, 17.8% and 11.5% respectively. The current lowest average selling price (from Sandoz) has dropped to US$0.26/1mcg, which is equivalent to 28% of the original research product price. Neupogen, which is somewhat stubborn and irreversible, has not lowered its price for many years, and has become the best in the original research product. A clear stream.

In addition to Zarxio and Nivestym, Releuko, which is sold by Amneal, was approved in February this year and is expected to be It entered the market in the third quarter and became a new member of the filgrastim family after four years. The BLA that Tanvex re-applied in November 2020 is still under review. Currently, there are no other products targeting the US market. A late-stage investigational filgrastim biosimilar.

6. PEGylated Filgrastim (PEG-filgrastim/PEG-GCSF)

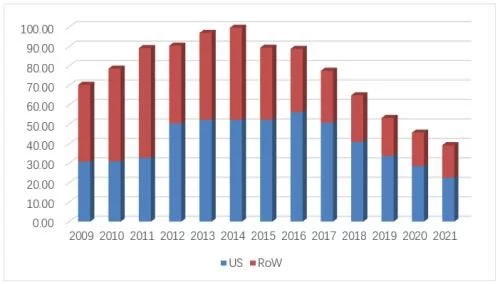

Neulasta, which only the United States can rely on, will still be out of sight in 2021. It seems that Onpro's temporary life extension is far from the end of the oil. It is not far away. The global sales after 6 consecutive declines have quietly fallen below 2 billion. With the decline of the US market, the future will be even more tormented, and the devastated and devastated situation has already come into view.

Neulasta's global sales list over the years

In 2021, Neulasta's U.S. market sales will drop to $1.514 billion, still accounting for 87% of global sales. The total market volume has further increased to 1.3 million, of which only the original product is currently on sale. The auto-injector product share has increased to 49%, and the prefilled syringe product, which occupies another 51% of the share, is in Amgen and Viatris, Coherus, Sandoz and Among the four Pfizer companies, Coherus' second-imitation product Undenyca accounted for 38% of the prefilled syringe product share, and Neulasta took 26% The share of the first imitation product Viatris' Fulfila and Sandoz's third imitation product Ziextenzo are both 17%, and Pfizer's product Nyvepria, which will be launched last in early 2021, only has a 3% share. Combining the two forms of products, the share of biosimilars has increased from 1.3% when they first entered the market in 2018 to 36.5% in 2021.

Before Zarxio entered the market in 2015, Neupogen's US market sales were already in decline, and in 2014 sales had dropped to 839 million, and before PEGGCSF's first imitation product, Fulfila, was launched, Neulasta's US market sales were as high as 3.9 billion US dollars and were still rising steadily. In addition, there was also an automatic injector Onpro as the trump card, although both products were from Amgen. , but there are obvious differences in price strategy. Compared with the stubbornness of "you are lower and you are lower" on GCSF, Amgen has adopted a step-by-step and retreat-oriented price strategy on PEGGCSF. , Judging from the latest ASP price in the first quarter of 2022, Neulasta is almost indistinguishable from several competing products, and its ASP price ($2021.33/piece) is tied with Sandoz's Ziextenzo for the lowest. Intense competition has driven the market price to continue to decline. The current lowest market price has dropped by 54% compared with the price of Neulasta when the first imitation was launched. In 2021, Udenyca, the biosimilar with the highest share, has a US market sales of 327 million, compared with the previous year. of 476 million fell sharply by 31%, and sales in the first quarter of 2022 were only $60 million, a year-on-year decline of 28%.

To a certain extent, auto-injector products are gradually becoming the direction of the future, and several biosimilar companies led by Coherus have also The development and layout of auto-injector products have been carried out. Among them, Coherus, which has the fastest progress, is expected to file for FDA in the second half of this year. In addition to the four biosimilar products sold in the market, the products of Fresenius, Amneal and Lupin are already in the FDA review process and are expected to enter the market after being approved in the second half of this year. In addition, Tanvex and DRL are conducting clinical trials for this product in the US market. In summary, PEGGCSF is very likely to become a molecule that competes with adalimumab on the same stage as 10 biosimilars in the future, creating a new history.

7. Etanercept

In 2021, Amgen, the "I'm in you, I'm in you" lawsuit artist Amgen wins again, succeeding last year After blocking the second wave of Sandoz's attack, he once again sacked Samsung, who had a glimmer of hope. The same moves and similar plots have successfully extended the Enbrel US market for eight years. Regardless of luck or strength, no one can succeed casually. Baojianfeng has been tempered, a little unwilling, a little lost, and he is good at what he does. Although he has died, he still has no regrets. In 2021, Enbrel's sales volume and drug prices in the U.S. market will decline due to changes in policies and measures related to distribution channels. The European market, which is under the responsibility of Pfizer, will also suffer from further penetration of biosimilars. Both lines have suffered setbacks, leading to global sales. Compared with the previous year, the amount fell by 15% to a new record low, and finally settled at 5.65 billion US dollars.

Enbrel's global sales list over the years

In 2021, Enbrel's U.S. market sales will fall to $4.352 billion (-10.4%), accounting for 30% of its global sales 77%, still Amgen's current No. 1 blockbuster product, accounting for 23% of Amgen's global sales. The overall sales in the US market fell to 6.53 million (-3.4%), 92% of which came from retail channels, and the proportion of powder injection products has dropped to less than 2%. Injection products include vials, cartridges, prefilled syringes, and automatic injection pens. Automatic injection pens have accounted for 65% of the total market share, while common prefilled syringes and cartridges are 20% of the total. And 12% share followed, the share of common vials has dropped to 1%.

In view of the current patent obstacles in the United States, Lupin, which has been listed in many global markets such as the European Union and Japan, no longer plans to file in the United States for the time being, and Coherus, which was in the clinical stage, has also stopped the project. , and there are no other new potential competitors seeking to declare the product in the United States in the short term.

8. Infliximab

The four-year unfair competition litigation battle with Pfizer has finally come to an end in 2021, and everything seems to be gone with the wind , everything started anew again as if it was a fledgling, the opponents were like shadows, and the battle was never far away. In the distribution channel, J&J's 360-degree sniping with no dead ends has converged, but the lingering sound still exists, and the synchronous follow-up of the price strategy "you are lower, I am lower" does not give the opponent the slightest chance to breathe, and the Remicade will fight to the end. In the end, he bid farewell to his 2021 with a record of seven consecutive drops of billions of dollars in the world. Under the general trend, his edge has subsided, but life is endless and the battle is endless.

Remicade's global sales list over the years

In 2021, Remicade's U.S. market sales will be $2.255 billion, accounting for 57% of global sales, compared to It fell by 21% in the previous year, and the overall market sales of infliximab in the United States increased to 9.08 million (+8.3%). Under the situation of gradual recovery, the overall share of biosimilars has increased from 15.8 in 2020 to 27.4 %, although the general environment under the restraint of J&J has been significantly improved, the policy changes at the government level and the acceptance of RA biosimilars by the public will still restrict the further penetration of infliximab biosimilars in the future. s efficiency. There are currently three biosimilars, Pfizer/Inflectra, Organon/Renflexis and Amgen/Avsola, with the first generic product Inflectra accounting for 18% of the market and achieving sales of US$385 million (+13%) in 2021. Renflexis and Avsola's share of sales was 7.2% and 2%, respectively. After biosimilars entered the market in 2016, the overall market price continued to decline. The current lowest ASP price of biosimilars has dropped by 56% compared with the original research price when the first imitation was launched. The current lowest average selling price (from J&J ) has dropped to US$34.4/10mg, and the lowest average selling price of biosimilars (from Pfizer) is US$36.5/10mg, equivalent to 106% of the price of the original research product.

The Japanese medical workers who have completed the Phase 3 clinical plan application in the United States have disappeared, and there are no other new potential competitors in the future. Seeking to declare the product in the United States in the short term.

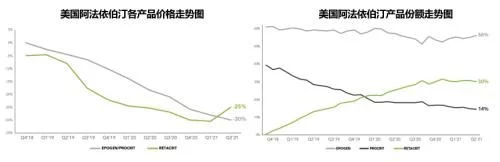

9. Epoetin Alfa

Biosimilars involved in molecular products, the oldest fighters in the new year staggered and staggered, After 19 years of continuous decline after the peak, Amgen's pioneering work Epogen/Procrit's global sales in 2021 has quietly reached 1 billion US dollars. It has no suspense that it has dropped again and again, and the story of a generation of legends will still be Keep writing, faith never ends.

Epogen/Procrit global sales list over the years

In 2021, Ebertin alfa's U.S. market sales fell to $744 million (-15%), accounting for global For 74% of sales, two original brand products, Epogen (from Amgen) and Procrit (from J&J, licensed by Amgen), contributed 70% and 30%, respectively. Since Pfizer's biosimilar Retacrit was launched at the end of 2018, no new biosimilars have been approved. In the past year, the overall U.S. market sales of this product increased slightly to 10.1 million units, and Retacrit's market share further increased to 46% , the US market revenue reached 344 million US dollars, an increase of 24% over the previous year, accounting for 78% of its global sales. The current lowest average selling price (from Pfizer) has dropped to $0.78/100units, which is basically the same as the original product price.

For the time being, there are no more relevant progress reports from other companies that plan to develop biosimilars of this product in the US market. Two The competition between one original product and one biosimilar will continue.

10. Insulin Glargine

March 23, 2020, 96 proteins including insulin, growth hormone, lecithin, hyaluronidase In accordance with the provisions of the BPCIA Act, the previously approved chemical drug NDA was converted into a biological drug BLA, and the definition of biological products was further scientifically improved while achieving compliance with the European Union. Previously, a series of biological products represented by insulin could not be returned. The embarrassing situation was finally broken. Time flies, and unknowingly, Lantus, the original research product of insulin glargine, has gone through 20 spring, summer, autumn and winter. The main battlefield in Europe and the United States has been under fire a few years ago. Eli Lilly used Abasaglar and Basaglar as the trade names in 2014 and 2015. Insulin glargine biosimilars were launched in the two major European and American markets, but Basaglar was still a chemical drug approved in the form of 505(b)(2). Since then, the two major markets in Europe and the United States have begun to decline simultaneously. In 2021, Lantus' global sales have dropped to US$2.49 billion.

Lantus global sales list over the years

In 2021, Lantus' U.S. market sales will be $861 million (-7%), accounting for $861 million in global sales 35%, the overall sales volume of insulin glargine injection in the U.S. market is 116 million pieces, and the product brand types are relatively complicated, but from the perspective of competition, it is still between Eli Lilly, Viatris and the original research Sanofi.

List of product information of insulin glargine injection in the US market

Sanofi launched an upgraded version of Toujeo outside Lantus in 2015, and today In May 2009, its subsidiary Winthrop, which is responsible for the sales of authorized generic drugs, launched a non-brand version, and in essence several versions belong to the category of biological brand new drugs; Viatris' Semglee obtained the 351(a) pathway after insulin was converted into a biological product last year. The biosimilars with interchangeable qualifications were approved in July 2021, and the Semglee-branded version and the non-branded version were launched in November, both of which are interchangeable, and the aforementioned The Semglee product approved through the 351(a) route has begun to withdraw from the market; Eli Lilly's insulin glargine biosimilar Rezvoglar, which was also approved last year, is not eligible for interchangeability and has not yet been launched. Basaglar, which was approved as a chemical drug and completed the conversion in 2020, is on sale.

In 2021, Sanofi will still have 72% market share, Eli Lilly and Viatris will have 26% and 2% respectively . Viatris' interchangeable-qualified biosimilar entered the market in November last year. The unbranded version, the WAC price of a pack of five 3ml injection pens is only $147.98, which is 65% cheaper than Lantus' list price and is by far the wholesale price in the market. Insulin glargine pens with the lowest purchase cost, while the brand-name drug Semglee has a WAC price of $404.04 per pack of five 3ml pens. Just slightly less than the price of Lantus ($425.31 for 5). By launching two different versions of the same product, Viatris is committed to giving payers the opportunity to choose between a high-priced, high-rebate product or another lower-priced, low-rebate product, which Sanofi and Eli Lilly have also cut separately. Taking measures to deal with it, the competition in the future will be more intense, and Viatris needs to pay attention to the fact that its off-brand version of the biosimilar product has been recalled once due to missing label after it was launched.

The insulin glargine biosimilar, a collaboration between Lannett and HEC, started clinical trials in the United States in March this year, and is expected to be as early as 2023 Annual application of BLA, Sandoz and Gan& Lee have announced the completion of Phase 3 clinical trials in Europe and the United States in October last year. Civica announced in March this year that it will cooperate with India's GeneSys Biologics to jointly develop the three major insulin biosimilars, glargine, lispro and aspart, which will be registered, produced and exclusively sold in the United States in the future.

11. Ranibizumab

Ranibizumab, born 16 years ago, successfully joined the family of biosimilar molecules in 2021, becoming a brand new One member, with the sudden emergence of competitor Eylea after 2014, the performance of Lucentis, a research product of ranibizumab, began to fluctuate in the two major European and American markets, and the off-label use of Avastin biosimilars with obvious price advantages after entering the market has also greatly increased. Affected sales of Lucentis, which had been on an upward trend. The previous threats of Lucentis came from various competing products in the same field. Since biosimilars have not yet entered the market, the direct penetration of products of the same molecule has been hindered. Although Lucentis has slightly fluctuated in Europe and the United States, it has never collapsed. In 2021, Lucentis' global sales will reach $3.647 billion (+5%), of which Roche, which is responsible for sales in the US market, and Novartis, which are responsible for sales in other markets outside the US, contribute 41% and 59%, respectively.

Lucentis global sales list over the years

2021 Lucentis U.S. market sales will be $1.487 billion (-3.2%), and the total market will be 1.28 million (+ 6%), almost all from hospital channels, and prefilled syringe products accounted for 99% of the total. The two specifications of 0.5mg/0.05ml and 0.3mg/0.05ml accounted for 78% and 22% respectively. In October 2021, Roche's other ranibizumab product, Susvimo (100mg/ml), received FDA approval for the treatment of wet AMD. Susvimo is administered intravitreally through an ocular implant compared to once-monthly injections of Lucentis. The injection only needs to be injected once every six months, which greatly facilitates the patient and will play a very important role in Riche's response to the competition of biosimilars.

Samsung Bioepis' ranibizumab biosimilar Byooviz was approved in the United States in September last year, becoming the United States with 351 (k ) The 31st biosimilar drug and the first ophthalmic biosimilar drug approved by the pathway have written a historic stroke. Samsung Bioepis has reached a settlement agreement with Roche, and the market of Byooviz will be realized as soon as June this year. The latest ASP price of Lucentis in the first quarter of this year is $266/0.1mg.

Except Byooviz has been approved for marketing, ranibizumab developed by Formycon, declared by Bioeq, and sold by Coherus in the U.S. market The biosimilar FYB 201 has been re-applied to the FDA in August 2021, and it is expected to be approved as soon as August this year. Previously, its BLA was declared in December 2019, and it was voluntarily announced in February 2020 due to supplementary data problems. The BLA was withdrawn in May. Xlucane, a ranibizumab biosimilar developed by Xbrane and marketed by Bausch + Lomb in the U.S.? The FDA filing has been delayed until this year. Lupin's LUBT010 is in Phase III clinical trials and is expected to end in October this year.

Looking ahead

In terms of registration, the clinical and review of new biosimilar products will still be affected by the epidemic for some time. However, there has been a delay and the FDA is also trying to use other tools and methods other than off-site inspections to evaluate the site in an effort to avoid the indefinite delay in inspections. Since 2022, two products have been approved. The Zizumab biosimilar Byooviz will also lead the launch boom in the second half of the year. In addition to the many products that were delayed due to inspections last year, it is expected that the number of product approvals and listings this year will exceed those of the previous two, which were slightly sluggish. year.

In terms of circulation, with the gradual deepening of the understanding and acceptance of biosimilar drugs in all aspects of the channel, biosimilar drugs Further penetration will continue and expand into two new areas, insulin and ophthalmology, based on the rapid progress in the past two years, and will still be affected by payer strategies, government policies, and education and training effects. Interchangeable qualifications The next performance of the product Semglee will become a new highlight of this year. The implementation effect of the exchange at the circulation level will test the water and will also provide a reference and a basis for strategy formulation for many parties in insurance companies, PBM and other channels. At present, the high-speed penetration of biosimilars is more reflected in the anti-tumor field. Taking ranibizumab, which will be launched this year as an example, the familiarity and recognition of biosimilars in the ophthalmology field is still relatively lacking. The speed of penetration will be relatively slow, and biosimilar drug manufacturers will gradually use more real-world research data for the promotion of biosimilar drugs in the future.

In terms of competition, with the gradual increase in the number of single-molecule biosimilars entering the market, the original research company is reducing prices as much as possible. While slowing down the shrinking of the original share, it will further provide patients with more convenience and comfort in use through the improvement of the original product prescription, injection mechanism and device, and compete with biosimilars in addition to the price lever adjustment, and inject every six months. One-shot Byooviz, Onpro auto-injectors without hospital trips, and 100 mg/ml adalimumab for re-prescribing are typical examples of such strategies. When biosimilars face the above-mentioned obstruction of the original research, they will also respond by short-term price reduction and long-term synchronization strategy follow-up.

In terms of research and development, the number of macromolecules involved in the research and development of biosimilars has reached more than 40, covering anti-tumor drugs and multiple therapeutic areas represented by autoimmunity, the application boom for the third wave of biosimilars that are expected to enter the market in the next two years is coming, and the fourth wave of biosimilars that can enter the market around 2030. The research and development of biosimilars has also been started. The premise of the competition in all aspects such as cost, quality and production capacity will still be that speed is king. The departure of large companies and the entry of more medium-sized companies will make the competition for biosimilars more stalemate and complicated.

On the policy side, whether it's signed bills such as the Promoting Biosimilar Education Act and the Ensuring Innovation Act or the A series of medical insurance plan measures aimed at lowering drug prices have shown the strong determination of the government to promote the rapid development of biosimilars. With the strengthening of the fight against unfair competition and the inclination of CMS (Centers for Medicare and Medicaid Services) to cover more biosimilars, the environment for the development of biosimilars will be more friendly.

Phone: 400-099-1215

Company address: Tide Valley Biomedical Industrial Park, Xinxing Park, Gu'an County, Langfang City, Hebei Province

Enterprise Email: boya@newcby.com

New Century Elite Life Technology (Hebei) Co., Ltd. Copyright(C)2021 Ji ICP preparation ******* No.-1